JACOBSON INSIGHTS

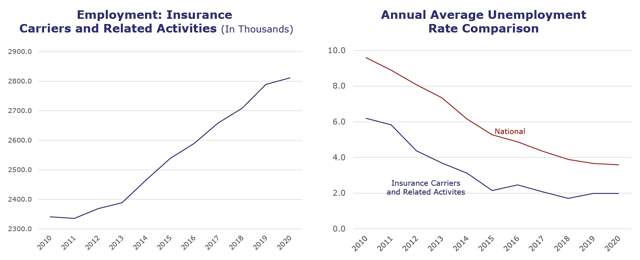

Insurance carriers and related activities experienced a sharp decline in unemployment last month, falling from 2.6 percent in January to 1.0 percent in February. Unemployment for the total U.S. economy remained relatively unchanged, dropping just 0.1 percent to 3.5 percent. Job growth, both for insurers and the overall economy remains high, with 5,500 and 273,000 jobs added in February, respectively.

The insurance industry also saw a year-over-year increase in weekly wages among nearly all its sectors. Most notably, claims wages increased by 20 percent compared to January 2019*. This could be due in part to a number of factors including automation impacting less skilled roles and fewer entry-level individuals entering the sector. According to Jacobson and Aon plc’s Q1 2020 Insurance Labor Outlook Study, insurers’ greatest needs in claims are experienced employees (55 percent), followed by entry-level employees (34 percent).

While the labor market showed continued strength in February, the BLS conducted its surveys prior to the spike in coronavirus cases outside of China. It’s likely next month’s report will reflect the impact of COVID-19 and other economic headwinds. By remaining informed and agile, with comprehensive talent strategies in place, insurers will be best prepared during these times of uncertainty.

INDUSTRY HIGHLIGHTS

BLS Reported Adjustments: Adjusted employment numbers for January show the industry saw an increase of 5,300 jobs, which is more than the previous reported increase of 1,000 jobs.

*The BLS reports on wages and employment for the industry category are only available for two months prior.