JACOBSON INSIGHTS

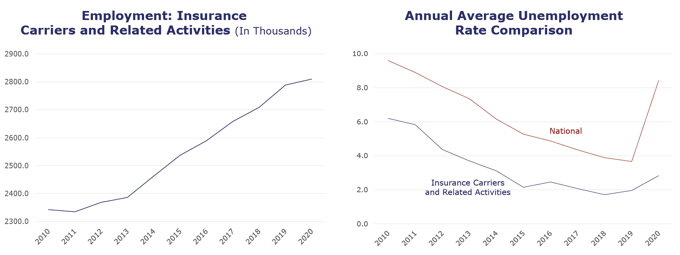

As we enter the fifth month of the coronavirus pandemic, unemployment for insurance carriers and related activities rose one percentage point month-to-month, to 4.6 percent in June. While this is the highest unemployment rate the category has seen since 2013, June also brought an increase of 6,300 industry jobs.

The agents/brokers and TPAs sectors have reported the largest loss of jobs since the pandemic began in March*, while other sectors have been less affected and some have experienced growth. However, the insurance industry historically lags behind the overall economy in terms of impact and there are still predictions for a second wave of layoffs that will more directly impact white collar roles. Within the larger finance and insurance category, layoffs declined between March and April** and the levels of voluntary separations and quits also fell.

INDUSTRY HIGHLIGHTS

BLS Reported Adjustments: Adjusted employment numbers for May show the industry saw a decrease of 8,400 jobs, compared to the previous reported increase of 300 jobs.

*The BLS reports on wages and employment for the industry category are only available for two months prior.

**April 2020 is the most recent available data from the BLS Job Openings and Labor Turnover Survey.

Source: U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities subsector.